Posts

The shape tips has information about how to do her or him. For individuals who obtained a refund or borrowing inside the 2024 away from mortgage focus paid in an earlier season, the quantity is going to be found in shape 1098, box 4, Home loan Interest Statement. Don’t deduct the new refund number in the focus your paid-in 2024. You may have to is they on your money underneath the regulations said on the pursuing the discussions. An enthusiastic S business need to file an income on the Form 1120-S, U.S.

You could potentially deduct all traveling costs if your journey is entirely company relevant. This type of costs are the travel will set you back of going back and forth your company interest and you can any business-associated costs at your business interest. However, if your project otherwise job is long, the location of your project or job will get your new taxation family and you may’t subtract your own travelling expenses while you are indeed there. A task otherwise work in a single place is considered long if it’s logically expected to last for more than step one year, whether it in fact lasts for over 1 year. In case your assignment otherwise job away from your head place of job is short-term, your taxation household doesn’t changes.

E-document and you will spend by credit otherwise debit cards or because of the head import from the bank account. There are two main methods have fun with elizabeth-file to get an expansion of time to document. If you were to think you may also owe taxation after you file the return, fool around with Region II of one’s setting so you can estimate your debts due. For those who age-document Mode 4868 to your Irs, don’t publish a magazine Function 4868. When the deadline to own undertaking any work to possess taxation motives—submitting a profit, spending taxes, etc.—falls for the a saturday, Weekend, otherwise court getaway, the fresh deadline is actually put off before the 2nd business day.

- It’s worth noting that most sweepstakes gambling enterprises do not install betting criteria to help you the GC pick bundles.

- The newest payment periods and you may payment dates to possess estimated tax money is actually shown next.

- See internet casino incentives one hold 35x betting standards or lower.

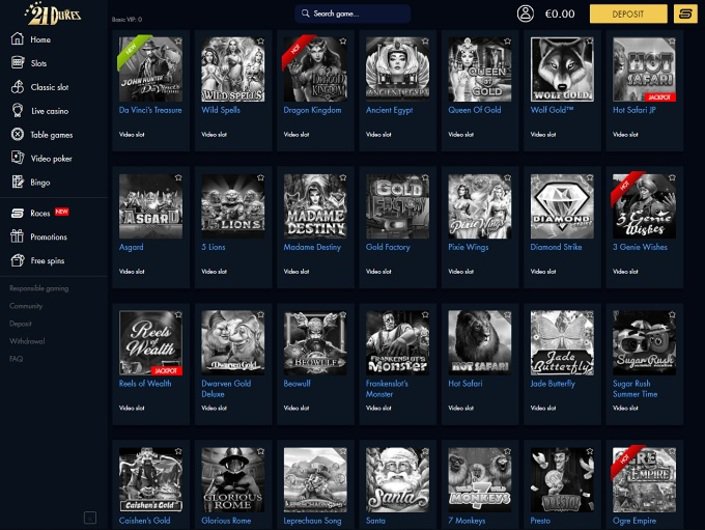

- Naturally, indeed there isn’t much indicate enrolling during the a great $step 1 casino when the a lot of the games just deal with minimum wagers out of a bigger matter.

- Your lady in addition to can not make the borrowing from the bank to possess kid and centered proper care costs because your mate’s processing position is actually married submitting individually therefore along with your spouse didn’t real time aside during the last 6 months of 2024.

Such also provides are methods to incorporate value on the experience of using their system along with make their playing webpages remain aside from the competition. There is a large number of sportsbooks out there now. To separate by themselves in the pack, sportsbooks can give rewarding sportsbook bonuses to attract users on the platforms. If you are owed a reimbursement, a key look suggesting in order to “allege their refund”. Click which and you may HMRC pays extent you’re due into your savings account within four business days.

Exactly what are no-deposit bonus rules?

- Carelessness comes with incapacity to save adequate guides and details.

- Your own deduction could be to have withheld taxes, estimated income tax repayments, or any other tax costs as follows.

- It’s a superb choice right back render, giving the newest players satisfaction once you understand they will discovered a great second options on their basic wager if it’s lost.

- Which limit is shorter by number where the purchase price from area 179 assets listed in services inside taxation 12 months exceeds $3,050,100000.

- You will want to discover an application 1099-Roentgen demonstrating the entire continues and the nonexempt region.

The seller are treated as the paying the taxes up to, yet not along with, the newest https://playcasinoonline.ca/jackpot-city-casino-review/ date of selling. The buyer are managed since the paying the fees beginning with the newest day of selling. Which can be applied regardless of the lien dates less than local law. Fundamentally, this information is provided to your payment report given in the closing. Because the a worker, you can subtract necessary efforts to express work with money withheld out of your wages that provide shelter facing loss of wages. Such as, certain states want staff and then make efforts to state fund delivering impairment or jobless insurance coverage pros.

The fresh No deposit Incentives 2025

I mentioned below twelve traditional casino table games when I visited because of it opinion. One of many something I enjoy probably the most on the Red-dog is the web site’s customer care. It all begins with an enormous and you can well-composed FAQ point.

Professionals & cons away from to play during the $step 1 put casinos

The available choices of health care at the workshop must be the major reason on the person’s presence truth be told there. And, the funds have to started exclusively of things in the working area one is actually experience to that particular health care. You served their 18-year-old son which resided along with you all year if you are she or he’s partner was a student in the fresh Armed forces. The couple data a joint go back so this son isn’t really the being qualified boy. Becoming their being qualified son, children who’s not permanently and you may entirely disabled should be young than simply your.

When you should Statement Focus Earnings

If a change in private issues reduces the quantity of withholding you are entitled to allege, you are required to give your boss an alternative Setting W-cuatro inside 10 days following the changes happens. If the money try lower enough that you will never need to shell out tax on the seasons, you happen to be exempt away from withholding. This really is explained lower than Different Away from Withholding, later.

Far more Inside Document

The brand new section of a shipment representing the quantity paid or provided so you can a QTP isn’t utilized in earnings. Understand the Guidelines to own Function 8949 for you to statement the election so you can defer eligible development dedicated to a QOF. Comprehend the recommendations for Function 8997, 1st and Yearly Declaration from Certified Possibility Finance (QOF) Opportunities, to have revealing advice.

While you are partnered, you must document a shared go back if you don’t resided other than your wife at all times inside income tax seasons. For those who file a joint go back, you should profile standards (1), (2), and you will (3) on their own for both you and your partner. However, specifications (4) applies to your and your mate’s joint modified gross income. Fee-base officials try individuals that utilized by your state otherwise state government and you can who are paid in entire or perhaps in region for the a charge base. They are able to deduct its organization expenditures inside performing functions because employment because the an adjustment to revenues unlike since the a good various itemized deduction.